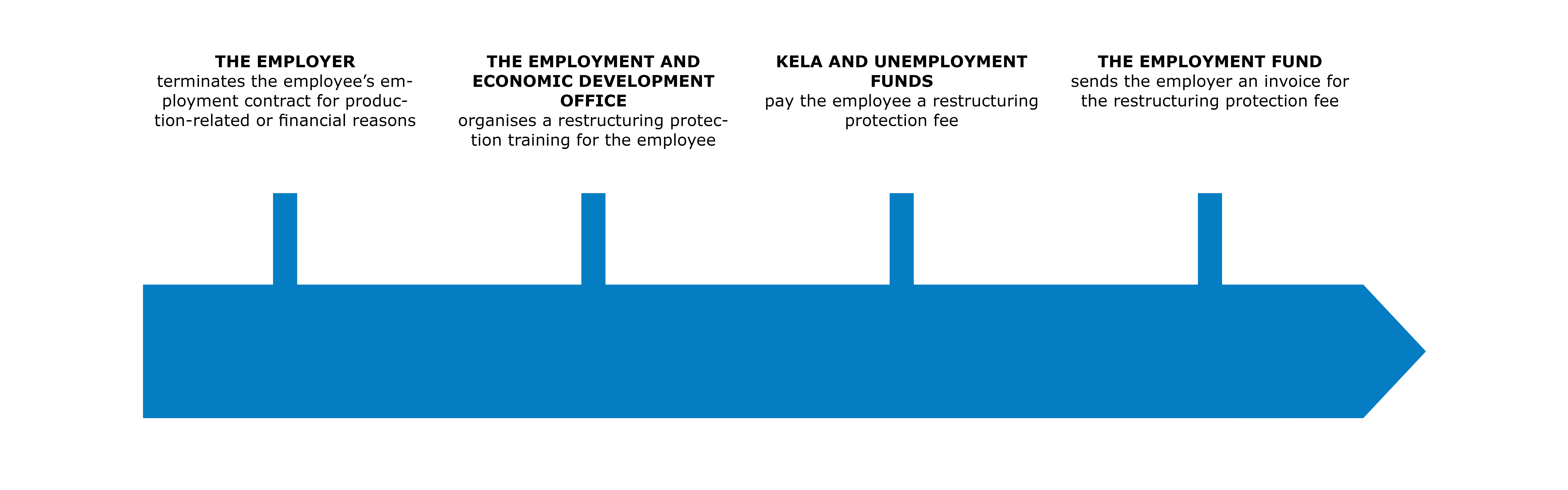

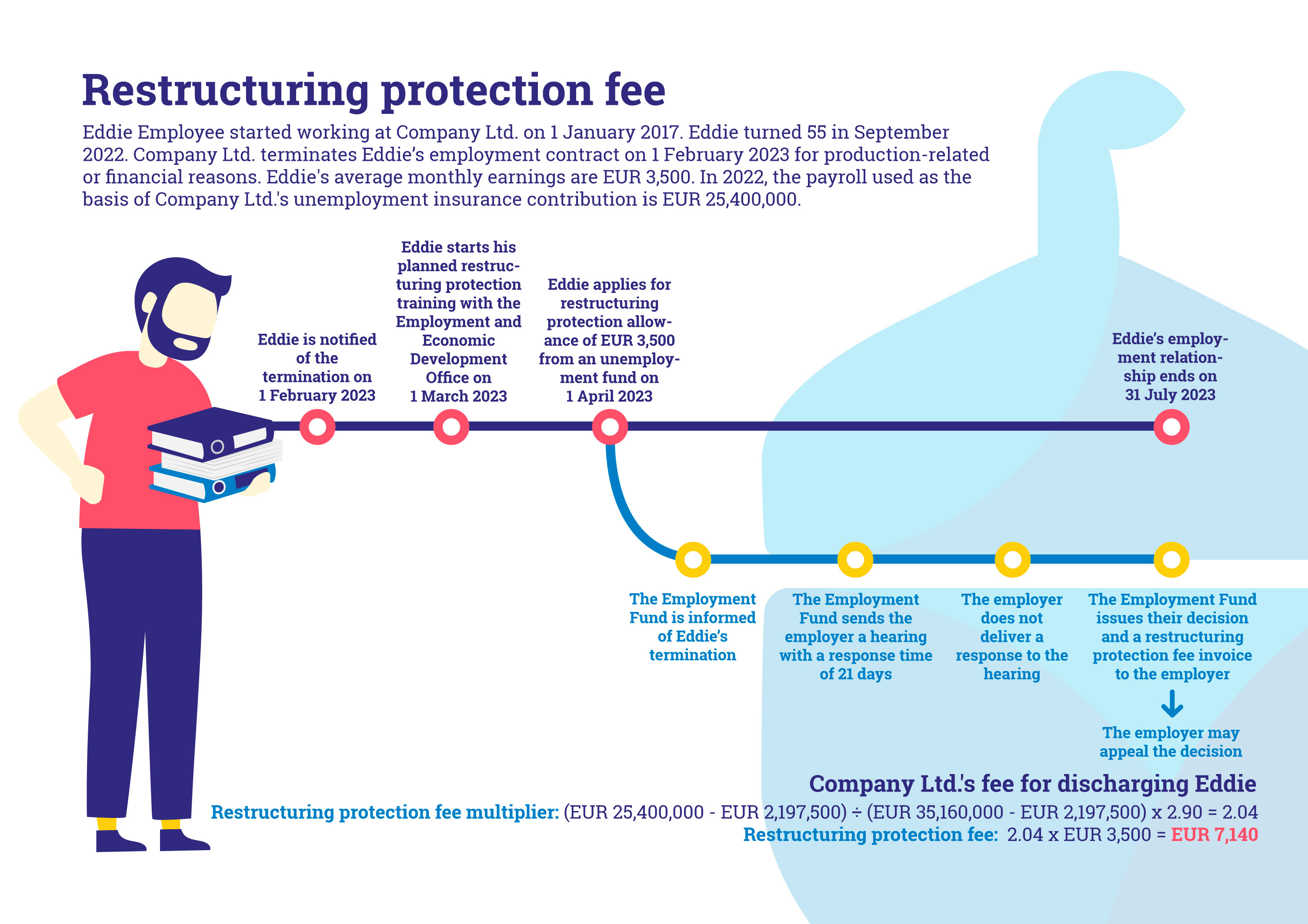

The employer may be obliged to pay a restructuring protection fee if the employer has terminated an employment contract of an employee aged 55 or over on production-related or financial grounds and the employee had been employed by the employer for at least five years. The restructuring protection fees are used to finance the employee's restructuring protection package. The restructuring protection package consists of two months of restructuring protection training organised by the Employment and Economic Development Office for the employee given notice and one month's restructuring protection allowance paid by an unemployment fund to the employee given notice.

The restructuring protection fee applies to employers whose payroll on which the unemployment insurance contribution is based exceeds the annually specified minimum level. The fee is based on the Act on the Financing of Unemployment Benefits (in Finnish).

The restructuring protection fee is a new fee. It will be collected as of 2023. The restructuring protection fee may be payable if the employment contract is terminated on or after 1 January 2023.

The employer may be liable to pay a restructuring protection fee if:

The restructuring protection fee applies to employers whose payroll on which the unemployment insurance contribution is based exceeds the annually specified minimum level. At the minimum level, the restructuring protection fee is zero. From the minimum level, the restructuring protection fee increases linearly to the payroll limit of full restructuring protection fee.

The restructuring protection fee is calculated on the basis of the payroll amount for the year preceding the termination.

A State employer’s liability restructuring protection fee is based on the payroll amount serving as the basis for the employee contributions of an accounting unit or unincorporated state enterprise.

The payroll limits are the same for the employer's liability component and the restructuring protection fee.

If the company has undergone a merger prior to the day of termination, during the year of termination, or in the year preceding the termination, the restructuring protection fee is determined on the basis of the merged companies’ total payrolls that served as the criterion for the unemployment insurance contribution of the year preceding the termination.

| Payroll year | Minimum level (EUR) | Maximum limit for full restructuring protection fee (EUR) |

| 2022 | 2 197 500 | 35 160 000 |

| 2023 | 2 251 500 | 36 024 000 |

The payroll limits are the same for the employer's liability component and the restructuring protection fee.

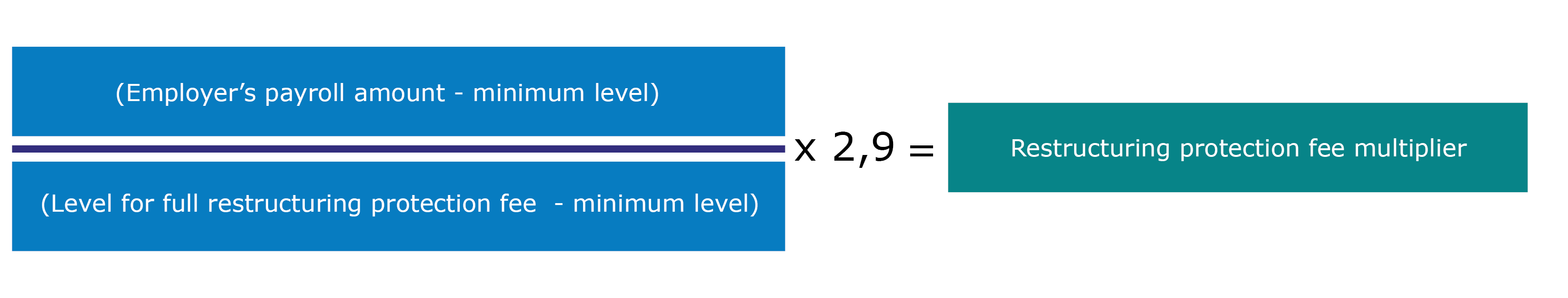

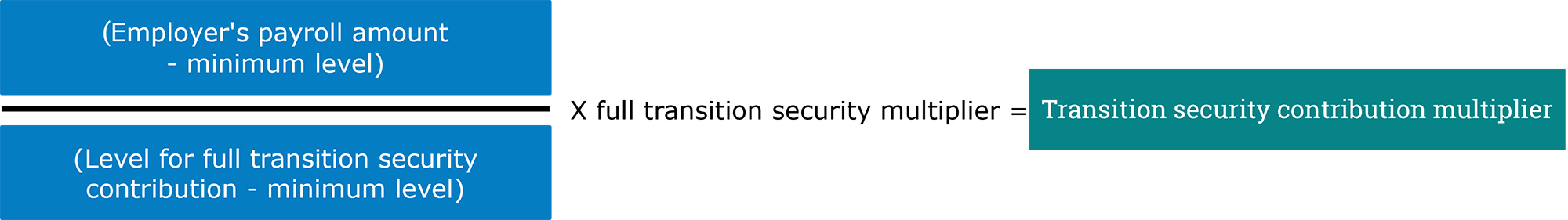

The amount of the restructuring protection fee is determined on the basis of the employer's restructuring protection fee multiplier. The restructuring protection fee multiplier, on the other hand, is determined on the basis of the payroll used as the basis for the unemployment insurance contribution. The restructuring protection fee multiplier increases linearly on the basis of the employer’s payroll.

The restructuring protection fee multiplier at the limit for full restructuring protection fee is 2.90. The figure may change annually.

In the formula above, the minimum level of the payroll amount for the year in question is deducted from the employer's payroll amount. The result is divided by the maximum limit for the full restructuring protection fee from which the minimum level of the payroll amount for the year in question has been deducted. The result is multiplied by 2.90 (the full restructuring protection fee multiplier).

You can also calculate an estimate of the restructuring protection fee amount and the restructuring protection fee multiplier using the restructuring protection fee calculator.

In addition to the restructuring protection fee multiplier, the payable amount is affected by the amount of the restructuring protection allowance paid to the employee by Kela or an unemployment fund.

The restructuring protection fee is calculated by using the following formula:

The restructuring protection allowance is a new benefit paid by Kela or an unemployment fund to the employee given notice. The first restructuring protection allowances will become payable in 2023. It can be obtained by a person who is:

This is a one-off performance and the amount corresponds to the employee's one (1) month average monthly salary over the past 12 months.

The grounds for the restructuring protection allowance are the salary under insurance paid by the employer terminating an employment contract and other compensation considered as earnings paid on the basis of the terminated employment relationship during the last 12 calendar months preceding the date of termination. Only earnings under an unemployment insurance contribution will be taken considered in the payroll. The amount of the restructuring protection allowance is calculated by dividing the aforementioned payroll by twelve. As a rule, the restructuring protection allowance is determined on the basis of earnings payment data obtained from the national income information system.

Only wages paid by the employer terminating an employment contract are considered as grounds for the restructuring protection allowance. If a person has salary earnings paid by another employer, they will not be taken into account. The restructuring protection allowance is determined on the basis of earnings paid in the last 12 calendar months preceding the date of termination, even if this period includes unpaid absences.

The average monthly earnings are calculated on the basis of wages paid over full calendar months. For example, if the termination takes place in June, the last paid wages considered will be those paid in May. The calculations are based on contributions. In other words, the time when the wages are earned does not matter. What matters is the time when the wages have been paid to the employee.

In exceptional cases, the liability to pay a restructuring protection fee may arise even if the person has not been paid a restructuring protection allowance, if their right to restructuring protection training or allowance has been rejected for a reason arising from the person. In this case, the Employment Fund determines the amount of the restructuring protection allowance on the basis of the data on the person’s wages obtained from the national incomes register.

We are notified by Kela or the unemployment fund of a person who has been entitled to restructuring protection or whose right to restructuring protection has been rejected for a reason arising from the person. If we notice that the requirements have been met, we will send a hearing letter to the employer. In the processing stage, we may ask for further clarification from the Employment and Economic Development Office, Kela or the unemployment fund, among others.

The employer has 21 days to deliver a response to the hearing letter.

A) The employer does not deliver response or declares that it accepts the contents of the hearing letter:

We issue a written decision on the restructuring protection, obligating the employer to pay the restructuring protection fee, and we send the employer an invoice for the restructuring protection fee.

B) The employer delivers a response:

We examine whether there are grounds for exemption from the restructuring protection fee. To resolve the matter, we may ask for further clarification from the Employment and Economic Development Office, Kela or the unemployment fund, among others.

If the employer is not satisfied with the decision, they may appeal to the Social Security Appeal Board. The employer can appeal a decision made by the Social Security Appeal Board at the Insurance Court.

For more detailed instructions see: appeals and refunds of the restructuring protection fee.

We advise employers on matters concerning the restructuring protection fee. With regard to matters related to restructuring protection training, advice is provided by the Employment and Economic Development Offices. With regard to matters related to restructuring protection allowance, advice is provided by Kela and unemployment funds.

See contact information here.

If you are dissatisfied with a decision we have made concerning the restructuring protection fee, you can appeal to the Social Security Appeal Board. You can appeal a decision made by the Social Security Appeal Board at the Insurance Court. Judgments made by the Insurance Court cannot be appealed.

Submit your appeal to us within 30 days of receiving notification of the decision. We will consider the employer to have received the notice on the seventh (7) day after the date when the decision was sent. We will consider State accounting units, municipalities and wellbeing services counties to have received notice on the day when the decision arrives. You will receive more detailed instructions on the appeal process and how to appeal along with the decision.

If we accept the demands set out in the appeal in all regards, we will issue a revised decision. If we are unable to adjust the decision that you are appealing in accordance with your demands, we will submit the appeal to the Social Security Appeal Board.

Note that employers must pay the restructuring protection fee even if the decision concerning the restructuring protection fee has been appealed. In such cases, you can petition the Social Security Appeal Board to suspend enforcement, either when you appeal or by submitting a separate application. If your appeal is accepted, we will refund the fee.

You can file for a refund of the restructuring protection fee if the employer has concluded an employment contract that is valid until further notice with the employee given notice during the period of notice or the re-employment period referred to in Chapter 6, Section 6 of the Employment Contracts Act (55/2001) and the employee has been in said employment for at least one year.

The employer must apply for a refund of restructuring protection fee within five years of the earliest date upon which the application could have been submitted.

Apply for a refund with a free-form application. Attach a clarification to the application indicating the type of employment and when it has started. To receive the refund, please provide the employer's bank account number in our e-services. The account number you provide will be used for all refunds.